Latest numbers on inflation and job growth were pretty good. For election forecasters, these are the “pocketbook” factors, which generally make the electorate like or dislike the incumbent.

CBS News/ MoneyWatch

U.S. inflation continued to cool in September, latest CPI data shows

Pretty big topic. I start with a few truisms. We complain more than we praise. We use words like prices have soared, but rarely talk about prices plummeting. Increasing demand for many commodities, cause prices to go up, as it takes time for supply to catch up for demand.

During an election year, we attribute inflation more on who is president than anything else. We hate strong economies because prices go up, and poor economies, because unemployment goes up. And the last truism, is that good government policies take time to see the benefits, and someone else can be running the government by that time.

We also over-react to headlines. There always at least one commentator who has drastic remedies, which come from exaggerated claims. For example egg prices. We all survived the egg crisis.

Egg prices are now $3.82 a dozen. That’s down from nearly $5.00 a dozen, but nobody is going around and saying the Biden administration did a great job in bringing down the cost of eggs. In the US, we had the largest bird flu epidemic in our history and 101 million chickens were slaughtered. It takes time to replace the flock. Government does help with agricultural losses, something we had to learn the hard way during the depression. But farmers still are part of the solution. Plus a strong economy means that demand is still good, even at higher prices.

Of course, eggs are not the problem. I use it simply to illustrate that higher prices and a stable demand provides strong motivation of farmers to replace their flocks. During Covid, the cost of many goods and services plummeted and unemployment soared. So, be careful what you wish for. Covid wasn’t Trump’s fault, and egg prices were not Biden’s fault.

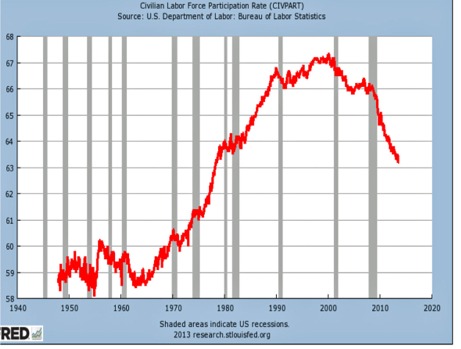

Economists are usually taking a much longer view. In March 2020, nobody really knew how long the epidemic was going to last. Many people in the hospitality and retail sector were losing their jobs. It was terrible for them, but the stimulus money helped some. Online courses allowed many to continue their education. It was mostly a case of adapting to a very different economy. We have since recovered.

The latest release of inflation index (Urban Consumer Price Index) shows a 2.3% increase in prices over last year. This increase doesn’t seem too bad. However, we are weeks away from the election so there is a lot of cherry picking of these numbers. Just for the record, unemployment and overall inflation has not skyrocketed this year. It has gone down.

Gasoline prices are down 10% and fuel oil down 7%, from last year. Average cost at the pump is $3.10/gal for regular gas. Many factors affect gas prices, but certainly high prices in 2022, gave homeowners a big incentive to consider energy saving measures like using LED lighting for their home and solar panels for both heating and power generation. Federal programs to provide incentives for electric vehicles purchases, also help in reducing the demand for gasoline.

Trump has an objective to cut people’s energy cost in half:

“If you make doughnuts, if you make cars – whatever you make, energy is a big deal, and we’re going to get that – it’s my ambition to get your energy bill within 12 months down 50%.”

Energy analyst Patrick De Haan, understood the mechanisms of supply and demand, in a recent NPR interview:

“It was President Biden that had eliminated leases in some areas on federal land. Now, keep in mind, federal land is a very small total of U.S. oil production on federal land, so it wouldn’t have a big impact, but ultimately, there are some things that the president can do to incentivize oil companies, but ultimately, it’s at oil companies’ whims if they’d like to increase production or not. And should oil prices decline to the point the president likes, it would be at a point where many oil companies are losing money on every barrel.”

Gas prices will not go to $1.50/gallon under Trump, unless the economy is really broken and unemployment is sky high. Gas prices in my area are 10% higher at around $3.30/gallon. New supply is directly related to new investments in exploration, which can take more than five years to bring onstream and many projects have taken over a decade, before production.

The cost of renting an apartment is in general higher on year-over-year basis. The average rent of an apartment in the US is about $2000/month. In Miami, it’s $1,000 more, around $3,000/month. According to Zillow, rents over the last year have been going down.

Zillow: https://www.zillow.com/rental-manager/market-trends/miami-fl/

Kamala Harris has a housing plan to help with rising prices. It’s focused on helping first time home buyers. For apartment renters, price fixing is real, and the intent is to stop free competition. So, while it didn’t make headline news, the Justice Department sued RealPages for using AI intelligence to set rental prices, in violation of antitrust laws.

I am certain Kamala Harris will give the Department of Justice all the support it needs, in pursuing antitrust lawsuits, like these to end price fixing of apartment rents. As a candidate collecting rents, rather than paying them, Donald Trump will likely be on the side of RealPages in fixing rents. Antitrust cases are not easily won.

Trump will install a business friendly Attorney General, and antitrust litigation will be history. He did his best to destroy the Consumer Finance Protection Agency, which intervened on the side of consumers in dishonest payday loan businesses, very similar to illegal loan sharking.

Link: The Harris-Walz housing plan – detailed, serious, and impactful

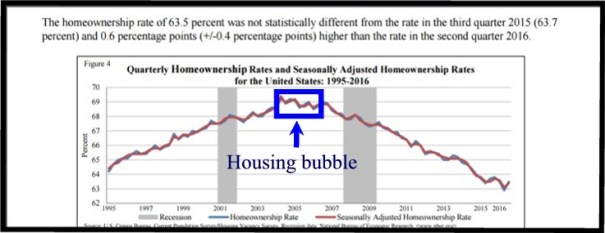

If the economy is doing well, it will take time for new apartments and houses to be built. So, the benefit to the housing plan will take time, if she can get it through the Republican controlled Congress.

So, Republicans are playing a very old game, and that is to attack the incumbent. Of course, the problem has been getting anything through the Republican led Congress which wants to make Biden look bad. Trump successfully killed the 2024 immigration bill, so he could tell the nation that our immigration policy was broken.

I’ll end this blog with a couple of links. One is a short video clip from Barrack Obama, with a very simple message. It can take years for bills to become law, and their impact can be in terms of decades. Trump cut taxes for the very wealthy, and our debt went up in the years that followed.

The second short link is about a totally false ad that Trump is using, that shows a video clip of Kamala Harris saying she will raise taxes. The video clip has been edited, and her comments were directed at the very wealthy. This is followed with another lie, that her tax policies will cost Americans $2580 per year. Actually, she has not proposed any such tax. Her tax increases are all focused on the wealthiest of Americans.

CNN Fact-Checker Says This Donald Trump Ad May Be ‘Most Deceptive’ Of 2024 Election

Of course, we have one candidate who gets his support from billionaires, like Elon Musk, who might be affected. Also, Donald Trump is able to show loses in his properties, so he pays nearly no tax.

So, yes the economy and tax policies are very hot issues in the election. I urge people not to vote for Trump and his doctored up video clips, and other dishonest actions. And the boast that he will drop the price of gas in half- are we that naive?

The economy may falter in the years ahead, but I feel she will continue to pursue good economic policies over politics.

Stay tuned,

Dave

Please share this blog if you agree with it.